Welcome to our first blog entry on the Companies Bill 2012!

We hope you join us and enjoy as we add useful content about the practical impacts of this ground breaking piece of Company Law legislation on Irish businesses.This blog sets the stage and gives you a brief background for the basis of the change and also explains how the actual Bill is structured.

Setting the Stage

Enactment of The Companies Bill 2012 is expected during November 2014 and commencement June 2015.

The Bill replaces the current Companies Acts 1963 – 2013, merges them into one piece of legislation and also includes some welcome additional reforms.

The CLRG Report back in 2001 stated that the “The private company limited by shares….should be the primary focus of simplification” and has set out to produce a “state of the art company law code”.

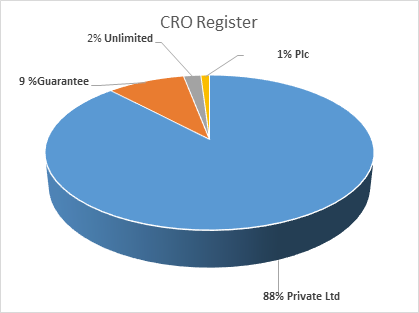

Breakdown of Companies by type on the CRO Register

The pie chart shows the breakdown of company type on the CRO Register

Currently, company law acts from the perspective that the majority of companies are plcs – placing a cumbersome administrative burden on small private companies.

As you can see the majority of Irish Companies (almost 90%) are private companies limited by shares.

Architecture of the Bill

The bill is set out in 2 sections. Volume 1 (15 parts) deals solely with Private Company Limited by Shares and Volume 2 (10 parts) deals with other company types; designated activity companies (DAC) PLCs, guarantee companies, unlimited companies, , unregistered companies and investment companies.

Private Companies Limited by shares are dealt with in Parts 1 –14 and Designated Activity Companies (DAC) dealt with by 1-14 and by 16; to the extent that 16 modifies or dis-applies the first parts, (table below refers).

| COMPANIES BILL 2012 | |

| Volume 1 | Volume 2 |

| Part 1: Preliminaries, housekeeping and definitions | Part 16: Designated Activity Companies |

| Part 2: Incorporation, registration and conversion | Part 17: Public Limited Companies |

| Part 3: Share Capital, shares and certain other instruments | Part 18: Guarantee companies |

| Part 4: Corporate Governane | Part 19: Unlimited Companies |

| Part 5: Director Duties | Part 20: Re-registration |

| Part 6: Financial statements, annual return and audit | Part 21: External Companies |

| Part 7: Charges and debentures | Part 22: Unregistered compnies and Joint Stock Companies |

| Part 8: Receivers | Part 23: Public Offers of securities, financial reporting by traded companies etc |

| Part 9: Re-organisations, acquisitions, mergers and divisions | Part 24: Investment Companies |

| Part 10: Examinerships | Part 25: Miscellaneous |

| Part 11: Winding up | |

| Part 12: Strike-off and restoration | |

| Part 13: Investigations | |

| Part 14: Compliance and enforcement | |

| Part 15: Regulatory and advisory bodies | |

All Private Companies Limited by Shares must convert to either the new “CLS” (Private Company Limited by Shares) , or the “DAC” (Designated Activity Company).

Our next blog will give an overview of the features of both the new “CLS” and “DAC”